GET IRS APPROVAL ON THE FIRST TRY.

Get your nonprofit 501c3 approval for as little as $247 today!

Reach out and speak to an expert about 200% guaranteed 501(c)3 application writing and submission services. An expert will be able to help you get started right away!

Up-Front Pricing:

"Express Launch" for Form 1023EZ Application $677 (or 3x $247 payments)

"Enterprise Launch" for Form 1023 Long Form Applications $1,297 (or 3x $477 payments)

All inclusive 501(c)3 application services.

You have a brilliant idea and want to set out to change the world or your community... but don't know where to start. Or maybe you've already started but you want to become official and legally recognized as a tax exempt company according to the IRS. "Instant Nonprofit" advisors can walk you through the steps to form your 501(c)3 with ease and efficiency.

How would you like to earn 501(c)3 tax exempt status with ever having to fill out a government form yourself?

Start your journey off on the right track. "Instant Nonprofit" will work with you to file and submit your 501(c)3 application. If we work together, we will ask for a list of documents and information for us to be able to put together the complete application for you. The process of working with Instant Nonprofit will take approximately two to six weeks and then we will wait two to eight months for approval. Our goal is to ensure your application is submitted correctly and approved the first time.

How would you like to earn 501(c)3 tax exempt status with ever having to fill out a government form yourself?

Start your journey off on the right track. "Instant Nonprofit" will work with you to file and submit your 501(c)3 application. If we work together, we will ask for a list of documents and information for us to be able to put together the complete application for you. The process of working with Instant Nonprofit will take approximately two to six weeks and then we will wait two to eight months for approval. Our goal is to ensure your application is submitted correctly and approved the first time.

|

All-inclusive 501(c)3 formation and applications services include everything you need to achieve federal nonprofit status!

Please be advised: Blackbird Philanthropy Advisors is not a law group and does not offer legal advice. Blackbird Philanthropy Advisors provides information to set you on the right course of action to successfully start a nonprofit. We offer services to complete the IRS Form on your behalf to save you time and to guarantee approval. You may opt for a formal legal review of all documentation by a licensed attorney for an additional $300 fee. Blackbird Philanthropy Advisors will provide a referral to you if you wish to have additional assistance on legal matters related to your nonprofit application, entity formation, and bylaws.

|

While we cannot guarantee every application will be accepted, we will do our very best to make sure that happens!

If for some reason your application is rejected without request for revisions, we will refund you 200% of the money you invested in the formation services, including the filing fee. |

How do you apply for nonprofit 501(c)3 tax exemption status without using professional services?

|

Got the time and know how?

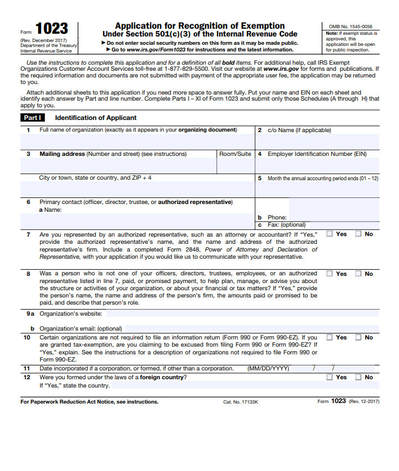

You have an option to file the IRS 1023 form yourself. Read through the form instructions. You'll see on page 25 of the instructions, the IRS reports that the average time is takes to complete Parts I to XI of Form 1023 is just under 105 hours. |

There are 27 types of organizations that can file for 501(c) status according to the IRS. The most common of all exempt entities is the 501(3) grouping "Public Charities and Private Foundations." To fall into this category, your company must serve an exempt purpose and have a mission that serves the public good, this includes: religious, educational, health, scientific, foundation, and other charitable types of operations.

When your organization is tax-exempt, your donors can deduct their contributions to your cause from their federal taxes. This is a huge incentive to invite the community to invest in your mission. Before you can file your IRS Form 1023 Recognition of Exempt status, you must have several documents in order:

Once you're ready to complete the form, prepare to pay the $600 filing fee, include a statement on your non-discrimination policies, another statement on your compensation policies, gather your narrative of activities to include in the application, and choose your NCSS activity designation code. You may be eligible to file an abbreviated Form 1023-EZ. The filing fee for this form is only $275 and is completed online via pay.gov. After you submit all of your documents, you should expect to wait 3-9 months for a decision. |