Social Impact InsightsOur blog provides insights for social impact professionals in business and nonprofits. We offer advice on making the greatest impact in your organization by giving clear real-world advice on important topics of today.

|

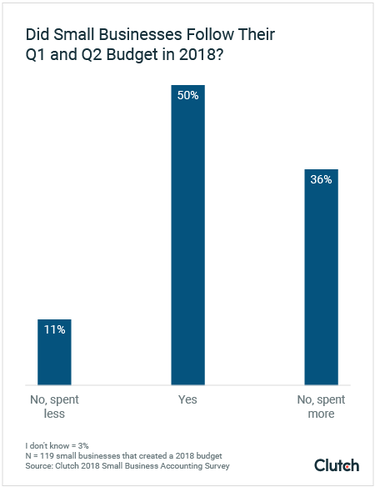

Small businesses should create a budget, according to a new survey report from Clutch, a B2B research firm in Washington, DC. Blackbird Philanthropy Advisors’ Managing Director, Caitlin Worm, provided expert commentary on the data, based on her experience counseling nonprofits and small businesses. The survey found that 61% of small businesses did not create an official, formally documented budget for 2018. Small businesses may have skipped a budget because creating one seems restraining or intimidating. Perhaps they believe that it’s impossible to stick to a budget considering the daily obstacles small businesses face. Yet, the survey also found that exactly half of small businesses that did budget were able to stick to their goals for quarter one and quarter two 2018. Businesses have a bit more flexibility with their budgets than households, Worm explained. “Business owners need to keep in mind that a budget is just a plan,” Worm said. “Sticking to a budget does not always mean the same thing in business as it does for a household. In a business, the potential to generate revenue has fewer limits than a household budget where one or two people earn a fixed salary.” Clutch’s survey did find that more than one-third of small businesses with a budget (37%) spent more than they planned in the first half of the year. This doesn’t necessarily mean these businesses are in trouble, though. “Overspending is not always bad – there may be investments that cost more early on than expected but will pay off in the near future,” Worm said. “Also, many times, spending more than budgeted could also mean that far more revenue was generated than expected – in that case, more expenses could be a good thing.” For businesses beginning to budget for the first time, Worm recommends caution. “New business owners tend to overestimate their potential to generate revenue quickly,” Worm said. “It’s actually better to underestimate and be ultra-conservative, than to be overly confident. Basically, try not to overestimate the amount of money you think you’ll receive. It’s far better to budget conservatively and end up with more money than you planned for, rather than to fall short.” When budgeting, consider the goals you’d like to reach, as opposed to just random numbers. “When creating a brand new budget, you need to have some specific, realistic goals in mind,” Worm said. “These can include: ‘To break even in Q3’ or ‘To have ten customers paying $10,000/year or more by end of the year.’ The budget should tell a story of how you will run your business and what goals you want to achieve.” Read Clutch’s full survey report here.

2 Comments

6/26/2021 04:46:55 am

Producing a spending plan can appear limiting or frightening for small companies. Maybe adhering to a budget plan considering the daily challenges local business deal with.

Reply

Leave a Reply. |

RSS Feed

RSS Feed