Social Impact InsightsOur blog provides insights for social impact professionals in business and nonprofits. We offer advice on making the greatest impact in your organization by giving clear real-world advice on important topics of today.

|

100 Ways to Engage Your Donors and Volunteers in your Nonprofit Mission Throughout the Year12/6/2023 Engaging donors is vital for building trust and securing future funding for nonprofits. This engagement creates a meaningful relationship beyond mere transactions, making donors feel valued and connected to the cause. By acknowledging their contributions and involving them in the mission, nonprofits foster a sense of community and partnership. This personalized approach deepens trust, showing donors that their support truly makes a difference. As trust grows, so does the likelihood of continued and increased donations. Engaged donors are more likely to become long-term supporters and advocates, spreading awareness and attracting more funding, thus fueling the nonprofit's ability to make a greater impact.

0 Comments

Many people wonder if they could afford to hire a nonprofit performance consultant. Our answer is simple in many cases: you can't afford not to. Do you want to be the best leader possible? Do you need an extra pair of hands? Do you need temporary support? Do you want to spend all of your energy working toward you mission? Would you like to improve in areas where you feel you face more challenges? These are all good reasons to hire a consultant. Running a nonprofit organization requires expertise across various domains, and sometimes seeking assistance from a nonprofit consultant becomes essential. However, understanding the costs involved in hiring a nonprofit consultant can be challenging. In this blog post, we will explore the typical costs associated with different services offered by nonprofit consultants, whether it's fundraising coaching, event management, strategic planning, or other essential areas. Fundraising Coaching: Fundraising coaching typically involves guiding nonprofits in developing effective fundraising strategies, donor cultivation, and campaign planning. Costs for fundraising coaching can vary depending on the experience and reputation of the consultant. On average, expect to pay a flat fee of $1,500 to $5,000 per month or an hourly rate ranging from $100 to $350. Special Events Management: For managing special events such as galas, auctions, or benefit concerts, nonprofit consultants can assist with planning, logistics, and execution. Flat fees for special events management can range from $3,000 to $10,000, while an hourly rate may fall between $75 and $250. Marketing Communications: Nonprofit consultants can help develop marketing strategies, branding initiatives, and communication plans to increase visibility and engagement. Typical costs for marketing communications range from $2,000 to $8,000 per month as a flat fee, or an hourly rate of $75 to $300. Website Development: When hiring a nonprofit consultant for website development, costs can vary depending on the complexity of the website, desired features, and customization requirements. Typically, consultants charge a flat fee ranging from $3,000 to $25,000 or more, depending on the scope of the project and ongoing maintenance needs. Fundraising Appeal Writing: Crafting compelling fundraising appeals requires expertise in storytelling and persuasive writing. The costs for fundraising appeal writing can be estimated at $500 to $2,500 per appeal, depending on the complexity and length. Performance based bonuses including percentage-based commissions, tiered incentives, or discretionary bonuses based on overall fundraising success may be part of the contract. Capital Campaign Management: Capital campaigns involve significant fundraising efforts for large-scale projects. Nonprofit consultants overseeing capital campaigns usually charge a percentage of the funds raised, typically ranging from 5% to 10%. Performance based bonuses including percentage-based commissions, tiered incentives, or discretionary bonuses based on overall fundraising success may be part of the contract. Grantwriting: Grantwriting involves researching, preparing, and submitting grant proposals to secure funding from foundations and grant-making organizations. Consultants may charge a flat fee per grant proposal, ranging from $1,000 to $5,000, or an hourly rate between $75 and $150. Performance based bonuses including percentage-based commissions, tiered incentives, or discretionary bonuses based on overall fundraising success may be part of the contract. 501c3 Formation: For organizations seeking assistance in forming a 501c3 nonprofit status, consultants can help with legal and administrative processes. Flat fees for 501c3 formation services can range from $2,000 to $10,000, depending on the complexity of the organization. General Nonprofit Administration Consulting: Consultants providing general nonprofit administration guidance offer expertise in governance, policies, procedures, and organizational structure. Costs for general nonprofit administration consulting may range from $100 to $400 per hour, or a flat fee based on the scope and duration of the project. Strategic Planning: Strategic planning consultants assist in developing long-term goals, objectives, and strategies for nonprofits. Costs for strategic planning services can vary widely, depending on the organization's size and complexity. Expect flat fees in the range of $5,000 to $20,000 or hourly rates between $150 and $500. Human Resources Management: Nonprofit consultants specializing in human resources can provide guidance on recruitment, performance management, policies, and compliance. Costs for HR management consulting may range from $100 to $300 per hour, or a flat fee based on the scope of work. Outsourced Bookkeeping: Outsourcing bookkeeping services to a nonprofit consultant can streamline financial management and ensure accurate record-keeping. Costs for outsourced bookkeeping services vary based on the size and complexity of the organization's finances. Typically, consultants charge an hourly rate ranging from $50 to $300 or offer a monthly flat fee starting from $500 to $2,500, depending on the volume of transactions and reporting requirements. It's important to note that these cost ranges are approximate and can vary based on factors such as the consultant's experience, geographic location, and the specific needs of your nonprofit organization. When considering hiring a nonprofit consultant, it's crucial to discuss pricing structures, deliverables, and expected outcomes to ensure a clear understanding of the services provided and associated costs. A cheaper hourly rate consultant may not always be the best decision. Take for example an inexperienced grantwriter who charges $50 per hour may end up billing you for 40 hours ($2,000) for something an experienced writer, charging $200 per hour, may be able to accomplish in 10 hours of work ($2,000) with a higher quality output and fewer errors. Remember, investing in the expertise of a nonprofit consultant can yield significant benefits by improving efficiency, increasing revenue, and enhancing overall organizational effectiveness. Carefully evaluating the costs and aligning them with your nonprofit's budget and goals will help you make an informed decision and maximize the impact of the services provided by a nonprofit consultant. Hiring a contractor or consultant to perform work for your company or organization could result in significant cost savings while also providing a high level of expertise you may not be able to afford otherwise. The cost savings associated with hiring a consultant versus a permanent staff member can vary depending on several factors such as the level of expertise required, the length of the project, and the specific scope of work. Here are some potential cost savings that organizations may experience by hiring a consultant rather than a permanent staff member: Lower Overhead Costs:

Reduced Hiring Costs:

Hiring a consultant instead of a permanent staff member can provide significant cost savings for organizations, particularly for short-term or specialized projects. However, it is important to carefully evaluate the costs and benefits of each option before making a decision.

As a nonprofit organization, you may be familiar with the concept of tax-exempt status. However, it's important to understand that there are some types of income that are not exempt from taxes, known as unrelated business income (UBI) tax.

What is Unrelated Business Income Tax? Unrelated business income tax is a tax on income that is earned by a nonprofit organization through a trade or business that is not related to the organization's primary exempt purpose. The purpose of this tax is to prevent nonprofit organizations from using their tax-exempt status to gain an unfair advantage over for-profit businesses. Examples of Unrelated Business Income Here are fifteen types of income that may qualify as unrelated business income:

Reporting Unrelated Business Income Tax Nonprofit organizations that earn unrelated business income are required to report it on Form 990-T, also known as the Exempt Organization Business Income Tax Return. The organization must file this form if it has gross income of $1,000 or more from unrelated business activities. In addition to reporting the income, the organization must also calculate and pay any taxes owed on this income. The tax rate for unrelated business income varies depending on the amount of income earned, but it generally ranges from 21% to 28%. It's important for nonprofit organizations to understand their obligations when it comes to unrelated business income tax. Failing to report or pay taxes on unrelated business income can result in penalties and potential loss of tax-exempt status. Consequences of Not Reporting UBI If a nonprofit fails to file Form 990-T to report their unrelated business income tax (UBIT), they may face penalties and potential loss of tax-exempt status. The penalty for failing to file Form 990-T is $20 per day, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less. Additionally, if the IRS determines that the failure to file was willful, the penalty increases to $1,000 per day, up to a maximum of $50,000. In addition to penalties, failing to report UBIT can also jeopardize a nonprofit's tax-exempt status. If the IRS determines that a nonprofit is engaged in a substantial amount of unrelated business activity and has not reported it, the organization may lose its tax-exempt status. Unrelated business income tax can be a complex topic for nonprofit organizations to navigate, but it's an important aspect of maintaining tax-exempt status and ensuring compliance with tax regulations. By understanding what types of income qualify as unrelated business income and how to report it, nonprofit organizations can protect their tax-exempt status and continue to serve their communities in a financially responsible manner. Choosing the right bank for a nonprofit organization is a crucial decision that can have a significant impact on the organization's financial stability and ability to achieve its mission. Nonprofit organizations may face several unique challenges when it comes to banking, such as difficulty accessing loans or lines of credit, limited options for fee-free banking, and the need to manage donor funds and maintain transparency and accountability. Additionally, nonprofit organizations often have fluctuating cash flows, which can make it challenging to maintain consistent account balances and avoid overdraft fees. With so many banks and financial institutions to choose from, it can be challenging to know where to start. In this blog post, we'll explore the key factors that nonprofits should consider when selecting a bank. 1. Mission Alignment The first and most critical factor to consider when selecting a bank for a nonprofit organization is mission alignment. The bank should share the nonprofit's values and mission, and be committed to supporting the organization's work. Nonprofits should look for banks that have a history of working with nonprofit organizations and have a track record of supporting causes that align with their mission. Because of the unique challenges related to banking for nonprofits, you will want to have a bank that has experience working with nonprofit entities. 2. Fees and Costs Nonprofits should be mindful of the fees and costs associated with banking services. Banks typically charge fees for various services, such as account maintenance, wire transfers, and ATM usage. These fees can add up quickly and eat into the organization's budget. Nonprofits should look for a bank that offers low or no-cost banking services or provides discounts for nonprofit organizations. 3. Accessibility and Convenience Accessibility and convenience are also critical factors to consider when selecting a bank for a nonprofit organization. Nonprofits should look for a bank that has a convenient location and offers online banking services, mobile banking, and payment processing. This will make it easier for the organization to manage its finances and access its funds when needed. If your nonprofit operates outside of your headquarters state, make sure executives can access the banking services from anywhere. 4. Customer Service Customer service is another essential factor to consider when selecting a bank for a nonprofit organization. Nonprofits should look for a bank that provides excellent customer service and is responsive to their needs. The bank should have a dedicated team that specializes in working with nonprofit organizations and understands the unique challenges they face. Consider the availability of customer service representatives and the responsiveness of the bank's support team. 5. Security and Fraud Protection Security and fraud protection are critical considerations for any organization, but they are especially important for nonprofits. Nonprofits should look for a bank that offers robust security features, such as two-factor authentication and fraud prevention tools. The bank should also have a system in place for quickly detecting and addressing any fraudulent activity. Ensure that the bank has robust security measures in place to protect your funds and investments from fraud or cyberattacks. Ask about their policies for data protection, encryption, and fraud prevention. Of course, you will also need to verify that the bank is FDIC insured, which means that your funds are protected up to $250,000 in case the bank fails. 6. Interest Rates and Investment Opportunities Nonprofits should consider the interest rates and investment opportunities offered by the bank. Nonprofits should look for a bank that offers competitive interest rates on its deposit accounts and provides investment opportunities that align with the organization's financial goals. 7. Reputation It's important to choose a bank with a good reputation and a history of stability and reliability. Look for a bank with positive reviews and feedback from other nonprofits or businesses, and consider their track record of financial performance. Conduct due diligence and research potential banks thoroughly before making a decision. This can include reading reviews and ratings, comparing fees and services, and asking for recommendations from other nonprofits or trusted advisors. Selecting the right bank for a nonprofit organization requires careful consideration of several factors. Nonprofits should look for a bank that shares their values and mission, offers low or no-cost banking services, is accessible and convenient, provides excellent customer service, has robust security and fraud protection measures in place, and offers competitive interest rates and investment opportunities. By taking these factors into account, nonprofits can find a banking partner that will help them achieve their financial goals and further their mission. Nonprofit organizations have long struggled with finding the right talent for their entry-level positions. However, there is a growing pool of untapped talent that nonprofits can leverage: teenagers. By hiring youth workers, nonprofits can not only fill their entry-level roles but also enjoy a host of benefits. By investing in youth workers, nonprofits can build a stronger, more innovative, and more sustainable workforce. Of course, it is important for employers to understand and comply with these child labor laws to ensure the safety and well-being of their young employees. Employers should go above and beyond to protect the wellbeing of all employees. Child labor laws are just the bare minimum expectation of how a minor should be treated in the workplace. Benefits of Hiring Teenagers for the Employer

Benefits of Having a Job for the Teenage Workers Having a job in their youth can provide numerous benefits for teenagers, both in the short term and in the long term. In this research brief, we will explore these benefits in detail. Short term benefits:

Long term benefits:

It is important to note, however, that there are also potential downsides to teenagers having jobs. Working too many hours can lead to stress and burnout, and may interfere with academic performance. Additionally, some jobs may expose teenagers to hazardous or unsafe working conditions. Employers should follow all child labor laws when hiring a teenager and monitoring their safety and work conditions. Having a job in their youth can provide numerous benefits for teenagers, including money management skills, responsibility, time management skills, social skills, work experience, career readiness, financial independence, better academic performance, networking, and confidence. While there are potential downsides to working, the benefits outweigh the risks for most teenagers. Protecting Minors from Exploitation, Abuse, and Unsafe Working Conditions Child labor laws are in place to protect minors from exploitation, abuse, and unsafe working conditions. When hiring teenagers to work, employers must adhere to these laws to ensure the safety and well-being of their young employees. Here are some of the child labor laws that employers must follow:

Ever wondered how to kickstart a nonprofit or a business? It might seem like they're worlds apart, but here's the scoop: the playbook for both is surprisingly similar! Whether you're aiming to make a difference or make a profit, the steps to get started share a lot in common. 1. Plan Like a Pro Running any organization begins with a clear plan, and that's where both nonprofits and businesses start. Think of it as a roadmap for your journey, outlining your mission, vision, goals, and strategies to reach them. While businesses aim for profitability, nonprofits focus on addressing societal needs, often relying on donations or program fees. Business Plan: This is your roadmap, your guiding star. In the business world, you're plotting a course to profit. You're figuring out what you're going to sell, to whom, and how you're going to do it. You'll dive into market research, analyze your competition, and chart out your financial projections. Nonprofit Plan: Here, it's all about your mission and impact. You're defining what problem you're going to solve, who you're going to help, and how you'll make it happen. You'll think deeply about your charitable programs, the people you're serving, and your fundraising strategies. 2. Get Your Papers in Order Beyond planning, both entities require formal governing documents that define their existence and operations. For businesses, it's typically articles of incorporation, while nonprofits create articles of organization or similar foundational paperwork. These documents serve as the constitution for your organization, explaining how it's structured, who's in charge, and how it operates. Business Incorporation: If you're going the business route, you'll likely file articles of incorporation. This legal document makes your business official. It outlines your corporate structure, management, and purpose. Nonprofit Articles: On the nonprofit side, you'll create articles of organization or something similar. These documents serve as the constitution for your nonprofit, explaining how it's structured, who's in charge (the board of directors), and how it will operate. 3. Spread the Word Marketing is a critical aspect for both businesses and nonprofits. It's about connecting with your target audience, conveying your organization's value, and creating awareness. While businesses aim to attract and retain customers, nonprofits are on the hunt for donors, volunteers, and advocates. The core principles of effective marketing strategy—building awareness, fostering engagement, and demonstrating impact—remain constant. Business Marketing: Businesses are all about selling stuff. So, marketing is your lifeblood. You're crafting messages that convince customers why they need your product or service. You're identifying your target audience, and you're shouting your message from every available rooftop, whether that's online, through advertising, or in person. Nonprofit Outreach: In the nonprofit world, you're not selling products, but you're selling a cause. You'll still be crafting compelling messages, but instead of customers, you're trying to attract donors, volunteers, and advocates. Your marketing efforts are about building awareness and engagement around your mission. Social media, storytelling, and community events are your allies. 4. Watch Those Finances Financial planning is universal. Both nonprofits and businesses require meticulous budgeting to allocate resources effectively, plan for growth, and ensure financial sustainability. The main difference lies in where the money comes from – donations, grants, program fees, or product sales – and the tax regulations you follow. Business Finances: Whether you're a small startup or a large corporation, finances are crucial. You'll create a budget to track income, expenses, and profitability. Your aim is to make more money than you spend, and taxes are all about profits. Nonprofit Budgeting: Nonprofits also live and die by the budget. You'll carefully allocate resources to programs, fundraising, and administration. The key difference is where the money comes from – donations, grants, program fees – and the tax rules you follow. 5. Win Hearts and Minds Fundraising for nonprofits and sales for businesses are like cousins. You're convincing people to invest in your vision. While the details differ, the art of building relationships, showcasing value, and demonstrating impact remains constant. Fundraisers appeal to donors' altruistic instincts, while sales professionals highlight the value and benefits of their products or services. Business Sales: In the business world, you're selling a product or service. Your sales team is all about building relationships with customers, demonstrating the value of what you offer, and closing deals. Customer satisfaction is a key metric. Nonprofit Fundraising: Fundraising is like sales for nonprofits. Instead of customers, you're courting donors and supporters. You'll build relationships with them, show them the impact of their contributions, and convince them that your cause is worth investing in. Success is measured in donations and the difference you make in the community. 6. Measure What Matters Ultimately, every organization, whether for-profit or nonprofit, seeks to make a positive impact. Measuring that impact is key. For businesses, it's financial metrics like profitability and market share. For nonprofits, it's social impact indicators such as lives touched, communities transformed, and societal progress. Business Metrics: Businesses track their success through financial metrics like profits, market share, and customer satisfaction. These numbers are essential for gauging performance, making strategic decisions, and staying competitive. Nonprofit Impact: For nonprofits, it's all about measuring social impact. You'll collect data on lives touched, communities transformed, and societal progress. Impact assessment helps you understand the difference you're making and refine your strategies to maximize your mission. 7. Think Outside the Box Innovation is the secret sauce for staying relevant. Both nonprofits and businesses need to adapt to changing trends, emerging technologies, and evolving stakeholder expectations. By fostering a culture of innovation and adaptability, organizations can remain resilient and responsive to the dynamic challenges they face. Business Innovation: To thrive, businesses must innovate. New technologies, market trends, and consumer preferences are ever-changing. You'll need to adapt, find new opportunities, and stay competitive. Nonprofit Adaptability: Nonprofits also need to be agile. You'll need to respond to shifting social needs, evolving donor expectations, and emerging trends in philanthropy. Embracing innovation helps you stay relevant and effective in your mission. 8. Be a Good Neighbor Finally, both nonprofits and businesses can play pivotal roles in community engagement and social responsibility. Businesses are recognizing the importance of corporate social responsibility (CSR) and the need to contribute positively to society. Nonprofits, on the other hand, are often deeply embedded in their communities and act as catalysts for social change. Business Responsibility: More and more businesses are taking on corporate social responsibility (CSR). It's about giving back to communities, reducing environmental impact, and operating ethically. Businesses are recognizing that being good neighbors is good for their brand and bottom line. Nonprofit Community Engagement: Nonprofits are often deeply embedded in their communities. They play vital roles in addressing social issues, fostering community well-being, and advocating for change. Collaborations with businesses can create powerful partnerships to tackle pressing societal challenges. Running a nonprofit or a business shares a profound commonality. It's not just about management skills; it's about the ability to envision change, mobilize resources, and navigate challenges. The distinction lies in the measure of success: in one, it's profitability, and in the other, it's social impact. But the commitment to purpose? That's what matters most. Whether you're making a profit or making a better world, it's all about making a meaningful impact. Closing down a nonprofit or small business can be a difficult and emotional process. However, it is sometimes necessary due to financial constraints, lack of resources, changes in the market, or other reasons. If you find yourself in this situation, it's important to know the steps you need to take to properly close down your organization. In this blog post, we'll outline the key steps you need to take to close down a nonprofit or small business.

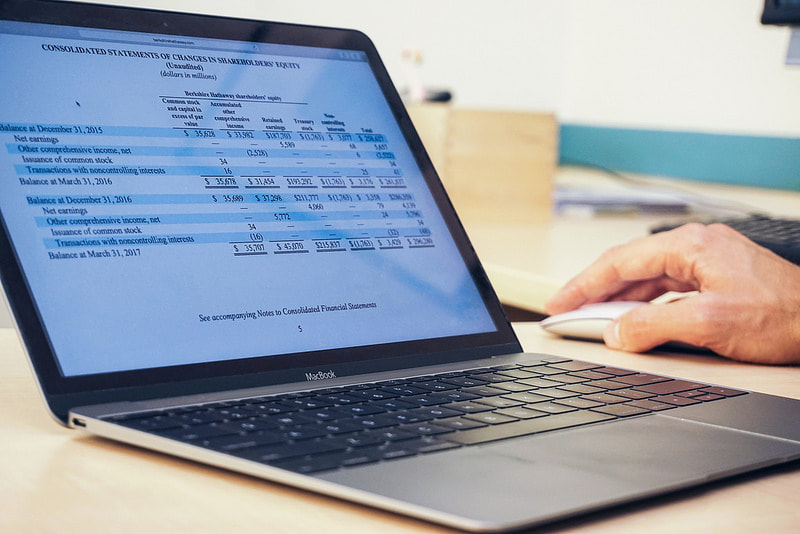

Closing down a nonprofit or small business can be a challenging process, but by following these steps you can ensure that you do so in a responsible and professional manner. If you need help with any of these steps, be sure to consult with legal or financial professionals who can provide guidance and support. All nonprofits registered as tax-exempt with the federal government must file an annual report with the IRS every year. No matter what income, asset, or activity level, your organization is required to file to maintain your active status as a 501C3 public charity or foundation. These forms may look very scary but are relatively straightforward if you have the right information available to you. You will need detailed information about your financials so access to full bank records is key. Of course, maintaining clean records throughout the year will make filling out the tax forms a breeze.

To fill out an IRS 990 form, you will need to have an EIN, basic organizational information, financial documents and records, information about the organization’s board of directors and officers, and revenue and expenditure information. Depending on the organization’s type, you may need to provide additional information or documents. The Five Main Types of Tax Exempt IRS 990 Forms The IRS 990 is an annual report that tax-exempt organizations must file with the Internal Revenue Service (IRS). It provides information about the organization's mission, programs, finances, and activities. There are five main types of 990 filings, and each one has a different purpose and filing requirement.

Each form is slightly different and provides different information. Form 990-EZ is the simplest form and is used to provide basic information about the organization. Form 990 provides more detailed information about the organization's finances, activities, and governance. The Form 990-PF is more detailed and focuses on the private foundation's activities, investments, and charitable giving. Form 990-N is the simplest form and provides basic information about the organization. Form 990-T is solely for tax exempt organizations that have unrelated business income that may be open to tax liabilities. Option for a Six-Month Extension to File There is a sixth form you ought to be aware of is Form 8868 "Application for Extension of Time to File and Exempt Organization Return." If the filing deadline is coming up quickly and you do not have all of your financial and organization information ready to submit your annual report tax form, then file an extension. Completing Form 8868 will put in a request to give you permission for a 6-month extension to complete your forms. What happens if you do not file your IRS 990 form? Failing to file your IRS 990 form can have serious consequences. The IRS requires organizations to submit a 990 form to remain in compliance with federal tax law. If an organization does not file a 990 form, the IRS may impose penalties and fines. These penalties can range from a small fine to the revocation of the organization’s tax-exempt status. In addition to penalties from the IRS, not filing a 990 form can also lead to a decrease in donations and grants from donors. Donors and grantmakers often use the 990 form to assess the legitimacy of an organization's work and its financial stability. Without the 990 form, the organization is not likely to receive donations or grants. Blackbird Philanthropy Advisors is happy to share general information related to nonprofit tax forms, however, we are not accountants. The best way to determine how to complete these forms is by contacting a tax professional who specializes in nonprofit accounting and finance. Contact us and we would be happy to provide a referral to a trustworthy CPA who can help you. Closing a nonprofit organization is usually the last thing that comes to mind when considering potential futures for an organization you’ve dedicated so much passion and time towards. It is natural for companies to run their course whether from successfully completing their mission or from a variety of issues that may arise like financial instability or loss of resources. In fact, an article by Candid evaluating various scenarios showed that 4 percent of nonprofits would close in the absence of a crisis. Our country is currently going through a unique crisis, one that has occurred only once in the past century. Battling the coronavirus pandemic has been difficult for everyone. Even with government aid and public willingness to support nonprofits, organizations may still be facing a variety of challenges. Evaluating your nonprofit’s status during a global pandemic with an honest approach is a brave action to take. Here is what goes into consideration when it comes to closing a nonprofit:

What to Evaluate When Looking at the Life of Your Nonprofit There are a number of reasons for dissolving a nonprofit organization. These all tie into whether or not you’re able to continue running a nonprofit.

Other organizations that rely on donations are also feeling the stress of the pandemic trickle through. Members of the community have been struggling to make ends meet during the pandemic. There have been many instances of lay-offs and furloughs since last March. Families are also having to deal with loss of income from being unable to work due to medical problems or quarantining. “Nearly two in five American households say they’re making less money since the start of the pandemic.” This limits the amount of charitable donations that people are able to make. While emergency funding through grants and loans are an option, relying on these for extended periods of time is not a solid strategy for the health of your nonprofit. Look over your available funds and income sources and if you see continued issues, it might be time to consider closing.

The coronavirus pandemic, along with public unrest stemming from social justice issues, has also boosted specific nonprofits to the forefront of peoples’ minds. Those making charitable contributions are dedicating their resources to those working on the frontlines, COVID-19 related nonprofits, and, in the wake of the Black Lives Matter movement, nonprofits that work to promote social justice. This leaves others like those focused on arts and education, for example, struggling with unexpected competitors. At certain times, there may not be enough bandwidth in the system to support as many nonprofits.

Throughout the crisis, Johns Hopkins University found that over 1.6 million nonprofit workers have lost their jobs. With many nonprofits being under-resourced even before the pandemic began, holding on to staff during difficult times may not be possible. Less staff may lead to the inability to carry out your organization’s work and limit your work towards your mission. Nonprofits are also facing a new problem when it comes to volunteer numbers. The pandemic has prevented people from being in close contact with one another which means organizations that rely on the help of in-person volunteers may feel the strain more than before. Sacrificing the work of an organization in favor for the safety of people is never a bad choice. Sometimes, people just become too burned out. This is understandable when it comes to running an organization you are passionate about. The past year has taken its toll on people in unimaginable ways. A lack of energy to dedicate to an organization may also be an important resource to take into account when considering closing your nonprofit. Actions to Take When Closing a Nonprofit There are a number of steps to take in the event of a nonprofit closure. One of the key points to remember is to keep your staff and your clients at the center of your actions. This means keeping people informed and approaching the situation with patience and empathy. Many people have dedicated time, energy, hopes, and even their hearts in your organization. Take the time to walk them through this process and offer support where you are able. These are important actions to take when going about closing a nonprofit organization. Each organization’s dissolution plan will differ according to their structure and needs, but here is a basic outline of an effective closure strategy.

It is also important not to forget federal and state entities in your notification process. You will need to file a formal intent to close with the state as well as submit final tax documentation to the IRS within a few months of closing.

Clients may suddenly have a gap that needs to be filled. Refund fees for unused services, refer clients to similar organizations in the area, or offer what help you are able to in the final days of your organization.

Estate planning requires juggling a variety of decisions involving property, money, and entities. When trying to decide what happens to your valuable possessions, many will usually set aside something to loved ones while also dedicating some of their fortune to a good cause. Those interested in pursuing a philanthropic option can do so by seeking out nonprofit organizations whose missions closely align with your values. When these plans are incorporated, it is known as “planned giving.” The trend used to be that many philanthropists would leave behind a trust or a foundation for giving to occur after they have passed. The responsibility then falls on heirs to ensure organizations are being properly funded and your wishes are being carried out. But, this tradition has become a way of the past. Many are choosing to give actively throughout their lives rather than saving everything for later. There’s plenty of good that can come from choosing to engage in philanthropy now rather than the future but it is understandable that many considerations come into play when deciding this. Pros and Cons of Giving Now and Later

One of the considerations that comes up when you decide to participate in charitable giving is the topic of anonymity. Depending on the type of person you are and the effects you are looking for, giving anonymously may seem like the way to go rather than making your donations well-known to everyone. There’s arguments for each side and ultimately, the decision is up to you. Before making your next philanthropic move, weigh the advantages and disadvantages of giving anonymously and publicly.

Giving Anonymously There are plenty of factors that go into making the decision to be anonymous in your giving. These can include your background, the organization you are supporting, etc. Here are the advantages and disadvantages associated with giving anonymously: Disadvantages

Advantages

Giving Publicly Disadvantages

Public donations are preferred by many organizations and offer them more opportunities and benefits than you may realize. For example, the more donors they are able to publicly include on their list, the more likely they are able to grow their work with the community. Not only does your donation help fund their projects, you name attached to a charitable gift can be used to help elevate fundraising efforts, create compelling stories, and help the organization build a relationship with you as a donor. Joining the board of directors for a nonprofit organization can be a major responsibility as well a major source of pride and excitement. Guiding a nonprofit and being along to see it obtain its goals is a worthwhile experience. But there are a few things to consider before taking on this role. Nonprofit board members should be actively involved with the organization and are expected to contribute financially in some shape or form whether this be through giving your time, dedicating your skills towards advancing the organization, or donating money. Before making the decision to become involved with a board of directors, make sure you understand the commitment you’re making as well as the organization you are serving.

1. Can I see a copy of your latest IRS Form 990? A form 990 is the form submitted to the IRS to determine whether or not a nonprofit organization can maintain its tax-exempt status. This form will include all of the nonprofits income and expenses including any money they have awarded through scholarships or grants, salaries of the organization’s five highest paid employees, donations, fundraising, etc. As a potential board member, you can use this form to evaluate the financial health of the nonprofit and whether its spending and saving habits fall in line with your expectations as a future member on their board of directors. Most nonprofits will make this form available to those who request it and some may even be found online through sites like Guidestar. 2. How much will I be expected to give each year? When you join a board of directors for an organization, it is usually expected that members will make some sort of personal contribution to the organization themselves. Board giving is a common way to demonstrate your support to the organization you serve and also positions you as a role model in the community for other donors. Expectations can vary based on the nonprofit you are working with so be sure to get informed before getting involved. 3. How much will I be expected to raise each year? Fundraising should always be one of the top priorities for board members. This is one of the key ways many nonprofit organizations raise enough money to accomplish their goals. Board fundraising can look like a variety of situations from creating connections with your own circle and identifying prospective donors to helping with fundraising initiatives and requesting gifts. It also includes bringing in resources, support, and skills into the organization. As a company, you can do plenty to make your business a more appealing place to work, and you can do even more to enhance the loyalty and satisfaction of your current employees. A Harvard Business Review article emphasized the importance of “reinforcing the right reasons for staying”. Creating conditions compatible with an employees’ values for working and living can include altering the work environment, providing more recognition, or investing in training. Tackling the aspect of an employee’s offer is also a way to go about instilling company loyalty.

While salary may be an obvious factor on the mind of employees, it has been shown in recent years that offering a valuable benefits package is just as important. People like to feel appreciated, wanted, and supported, and will be more likely to remain with your company for years if they feel secure in their position. One way to help your employees to feel more secure and loyal to your company is by offering additional benefits, something many professionals will give up higher salaries to receive. Please note, we are not a law firm or accountant firm. This is for informational purposes only. For information on tax and legal matters, we suggest consulting with an attorney or CPA who is knowledgeable about your industry and needs as an employer. Non-Taxable Fringe Benefits Fringe benefits are additions included in an employee’s hiring package on top of the compensation. Examples of these can include a variety of insurances, employee discounts, stock options, tuition assistance, paid lunches, fitness reimbursements, or even pet-friendly work environments. According to the IRS, any fringe benefit you provide an employee is taxable and needs to be accounted for. However, there are exclusions to this that companies can focus on to bolster an offer package and keep employees loyal, happy, and retained. These are known as non-taxable fringe benefits. Non-taxable fringe benefits are particularly attractive to employees since these include employer-provided benefits that they won’t have to pay taxes on. Offering non-taxable fringe benefits helps your employees to keep a larger portion of their salaries while still receiving all the support they need, helping them to lead more financially secure and happy lives. De minimis (minimal) benefits De minimis benefits are considered tax-free because they are items or services offered by the employer that have so little value it would be difficult to account for. Under this section of IRS code, employers would be able to incorporate things such as occasional meals, snacks, and company parties, or gifts like tickets to events or holiday gifts. While these added benefits are minimal, hence the name, they make a big impact on office culture and employee morale. When paired with recognition and regular feedback, it was found that companies had 31% lower voluntary turnover than those with ineffective programs. Dependent care assistance Taking care of your employee’s family helps you take care of your employee. Childcare and dependent assistance ranked second on benefits that employees could not live without. Employers are able to cover the first $5,000 of dependent care assistance. This applies in a variety of situations and can cover children under the age of 13 as well as children or spouses who cannot mentally or physically care for themselves. Educational assistance Building new skills or earning degrees is a benefit that can attract and keep employees. The IRS allows an employer to make up to $5,250 in tax-free contributions each year to an employee’s educational expenses. This could mean covering tuition, class fees, or learning materials like textbooks. The way the funds are distributed is up to the employer, for example, you could give employees money in advance to cover classes, give employees money as reimbursement after classes are completed with passing grades, or split the money by giving them half the funds to start with and the remainder after successfully completing classes. To keep these benefits non-taxable, these funds are only for the employee to further their own skills or in education only for work. This means it doesn’t cover family members. While it can’t cover the children of your employee’s high school education, it can be used to help your employee achieve their own diplomas. In addition, educational assistance can also be used retroactively to pay off loans that employees may have taken out in the past for school. This can be done by adding money to each paycheck that is used specifically for student loan debts. Athletic facilities Employee wellness happens outside of the workplace as much as it does in the workplace. Access to exercise benefits ranked in the top 15 most popular benefits desired by employees. Unum, a benefits provider, found that a third of employees desired company-paid gym memberships or access to a fitness center on the job site. While paying for memberships can come out of your employee’s paycheck, building an in-office gym is a non-taxable option that companies can look into to boost their appeal. In-office perks come at no cost to employees but are shown to be desired by almost 80% of employees when looking at job benefits they want. Employee discounts Partnering with other companies and service providers to offer discounts to retailers, hotels, amusement parks, etc. is enticing to include in an hiring package. These discounts can range up to 20% off and may apply to discounted Disney World tickets or contribute to their next Apple shopping trip. A study found that more than a third of employees who didn’t already have company discounts wanted it. Employee discount programs can go a long way and it is easier for companies to take on these low cost-per-employee fees to curate discounts that their work staff will be interested in. A complete list of other benefits excluded from income taxes includes:

There are other benefits you should take into consideration if your goal is to create a world-class, competitive workplace that fosters growth and loyalty and allows you to recruit the most talents and qualified team possible.

Please note, we are not a law firm or accountant firm. This is for informational purposes only. For information on tax and legal matters, we suggest consulting with an attorney or CPA who is knowledgeable about your industry and needs as an employer. Learn more about how you can support your employees and help them lead happier, healthier, more prosperous lives by visiting Blackbird Philanthropy Advisors online today and checking out our blog! The COVID-19 virus has rapidly changed the way we live our daily lives. Businesses and nonprofits have been struggling with the economic impact and additional hardships brought about by the pandemic. There are a variety of relief funds available for businesses that need extra help during this unprecedented time. Recently passed legislation included $900 billion in aid to those affected and many foundations have set aside COVID-19 specific funding available to small businesses, nonprofits, and individuals.

CARES Act and Pandemic Relief Bill The new stimulus package passed just before the holidays included relief and aid to individuals and businesses who were awaiting news of the next stimulus package. This relief bill contained renewals of a variety of funding offered through the first stimulus package and includes a variety of aid for specific populations and small businesses/nonprofit organizations also. COVID-19 Economic Injury Disaster Loans The CARES Act includes $20 billion for EIDL grants (economic injury disaster loan program). These grants are meant to provide economic relief for small businesses and nonprofit organizations that are experiencing a temporary loss of revenue and include aid for businesses in low-income communities. EIDL funds can be used to help cover normal operating expenses including health care benefits, rent, utilities, etc. Entertainment and Theatre Venues $15 billion of CARES Act funding has been set aside to help entertainment and theatre venues. This is known as the “Save Our Stages” Act and includes live venues, independent movie theatres, and cultural institutions. Organizations will need to have experienced a 25 percent revenue decline compared to same quarters from previous years. These allocations can include up to $10 million in aid for each organization. The Small Business Administration (SBA) is currently working on applications which will be posted on grants.gov and will host a pre-application informational webinar beforehand. Paycheck Protection Program (PPP2) An additional $285 billion in loans was approved under the Paycheck Protection Program. This funding is available to those with fewer than 300 employees that experienced at least a 25 percent decrease in revenue from quarters from previous years. $12 billion of this funding was specifically earmarked for minority-owned businesses, ensuring that many diverse and low-income communities will receive the aid they need to sustain their businesses. Applications for Paycheck Protection Program loans are currently being accepted by the Small Business Administration (SBA) from participating community financial institutions (CFIs) and lenders. Click here for access to the full text of the bill. Grant Funders and Foundations For those looking for funding outside of federal opportunities, there are many grant funders and foundations who are providing aid to small businesses, nonprofits, and individuals. Small businesses, nonprofit organizations, and individuals who are looking for a resource list of available grants and funding opportunities can utilize the following websites for their searches:

Small Businesses

Nonprofit Organizations

Individuals

The COVID-19 pandemic and the need for social distancing have changed pretty much everything about how we live and work, and for nonprofit organizers, even the way you fundraise has changed. Fundraising and fostering donors used to be a social job, one that required lots of face-to-face interaction with donors at special events. No longer able to engage donors in person, fundraisers everywhere are discovering new ways to keep donations coming and keep their donors invested in their cause. Here, we’re sharing 10 of the easiest, most creative, and most effective ways to engage your nonprofit donors virtually. 10. Share a Message From The Top Nonprofit leaders and executives have difficult, time-consuming jobs, requiring them to be excellent delegators as well as leaders. Because of this, not all nonprofit leaders manage to personally thank or reach out to donors, or only make appearances on occasion for important moments. Now, with uncertainty and confusing consuming everyone’s lives, sharing a message from the top of your organization can help to put your donor’s minds at ease. Recruit organization executives to share their take on the current state of the world, to offer words of advice or encouragement to donors and followers in the form of a letter or email, or to make a short video thanking everyone for their continued support through difficult times. Showing that the individuals at the top of your organization are paying attention to what the world and their donors are experiencing will help maintain active volunteer and donor active engagement in your cause. 9. Organize a Webinar Was your organization planning to host special events, courses, seminars, or other events in 2020? Do you already have speakers, presenters, and panelists lined up and on the schedule? Have you already sold or handed out tickets to the event? Don’t worry about your hard work being for nothing just yet; pivot your event and create a webinar where you can virtually host presentations, panel discussions, interviews, and much more. 8. Send a Weekly E-Newsletter With so much uncertainty in the world, it’s nice to have something you can depend on, which is why you should start sending a weekly e-newsletter to your donors. Keeping donors in the loop will not only help to remind current donors that your organization still exists and is doing good work, but can also help you to retain donors that may be unable to donate during the pandemic, encouraging them to come back and donate once they are able. 7. Create an Online Fundraising Campaign If you have never tried fundraising online, this is the perfect moment to give it a go! There are tons of ways to set up fundraising campaigns online, most of which are so easy you can do so in just minutes. Some social media platforms now include built-in fundraising tools where followers can donate with the click of a button. You can choose a dedicated fundraising site like GoFundMe. You could even organize a simple campaign using PayPal or Venmo to collect donations. 6. Start a YouTube Channel Like an e-newsletter, creating a weekly YouTube video to update donors and followers about what your organization is up to during the pandemic. If donations made by your supporters go to physical goods, create a short video showing the attaining and gathering of the items paid for with donor support. If donations go to providing community services, show your donors what facilities they contribute to or how those services are accessed by the community. Anything you might share in a newsletter can easily be shown in a video, and can help you to reach a wider range of donors. 5. Call Your Donors Personally While you can’t meet face to face with your donors to thank them for their support, you can still reach out to them one-on-one over the phone. Personally calling and thanking donors is a great way to show them that their donation makes an impact, and will help them to feel appreciated by your organization. Even if no one picks up, a quick message personally thanking them could be the thing that brightens their day and reminds them to donate again. 4. Host a Live Q&A Social media platforms like Instagram and Facebook have ‘live’ functions, which allow users to stream themselves to their followers in real-time. For nonprofit organizations, this can be a great way to boost donor engagement, and answer some commonly asked questions in front of a sizable audience. Share with your followers a few days beforehand that someone will be hosting a live Q&A from your organization, and keep reminding them up until the time you go live. Stick around for at least half an hour and encourage followers that tune in to ask questions and engage in the chat. 3. Post On Social Media Using social media to raise awareness for nonprofit organizations is nothing new, but now, with mandated social distancing in place for the foreseeable future, social media will become your main way of communicating with your donors. Regularly posting to all your social media accounts and keeping your content consistent across platforms is super important for remaining at the top of your donor’s feeds, since everyone else is at home and working hard to boost their social media presence too! Consistency is key. 2. Collaborate with Other Nonprofits Collaborating with another nonprofit involved in the same cause as your organization to post promotional or educational material on social media is a great way to expand your audience, and show that your organization has good relationships with other respected nonprofits. Cross-promote events, share each other’s posts, be active in the comments section, and do your best to highlight the best parts of each of your work. 1. Share Important News Right now, everyone could use a little good news, which is exactly why you should be sharing every positive event with your donors. When important or exciting events or milestones are reached by your nonprofit, shout it from the rooftops - or at least on your social media. Share success stories, good news from the community, exciting or positive news relating to your cause, and more. Some nonprofit organizers make the mistake of believing that their work with donors is done once they have received donations, but in truth, the work of fostering relationships with and connecting with donors is never complete. The first donation should be the first of many, and if you have put in the time and effort to cultivating close relationships with your donors, this will happen naturally.

One of the best ways to create relationships with donors and to keep them interested in your organization is by regularly keeping in contact, and the easiest way to do this is through an e-newsletter. E-newsletters can be sent via email or text, and can be displayed on your website for visitors to peruse. The newsletter format helps to keep donors informed of the goings-on of your organization, and acts as a gentle reminder that you are still out there and doing work that needs to be funded. Sending donors and supporters of your organization regular information regarding your nonprofit’s progress and work is also a good way to build trust, since your e-newsletter is the perfect place to demonstrate good stewardship. What To Include In Your Newsletter Whether you have written hundreds of newsletters, or are reading this as your first step to creating an e-newsletter for your nonprofit, the most important thing to remember is to include only information and stories your donors would be interested in. Magazines curate articles and content based on what their readers are interested in, which is why you don’t see much fashion in Bassmaster and you don’t often find mention of river safety in US Weekly. Like entertainment publications, you should be sticking to the content your donors want to see, like success stories from people, organizations, or communities that have benefited from your work. Donors like to see the impact of their donations, and including success stories in your e-newsletters is a great way to do just that. Other content that can help you to build your donor network and keep individuals engaged could include information on upcoming events, project and program updates, information on relevant news and current events, and information on how donors can volunteer, donate, and help. Every nonprofit leader and fundraising professional knows the amount of work it takes just to seek out funding opportunities, much less how difficult it can be to actually land a corporate donation, grant, or sponsorship. While individual donations and fundraising events help to manage day-to-day operations, these larger corporate donations can help to fund projects, community initiatives, organizational expansion, and so much more.

For some smaller nonprofit organizations, landing a corporate donation can feel like a long shot, especially if they have never sought out donations beyond crowdfunding or individual donations. In truth, nonprofits at every level can earn corporate donations, and you don’t have to have long-standing relationships in the world of business to get started. If you want to work with corporate sponsors to increase funding for your nonprofit, try using some of these strategies to get more donations. Build Relationships at Every Level A common misconception among smaller nonprofit groups is that you need to be connected at the highest level of a corporation in order to stand a chance of qualifying for donations. This misconception likely comes from the fact that nonprofit fundraising professionals and organization leaders do typically build relationships with corporate leaders, but this fact should not be misinterpreted to mean that opportunities lie only at the top. When your organization is seeking out corporate donations it is important to take every possible opportunity to network, which means talking to people from every level of the companies you want to work with. Small, seemingly insignificant conversations about the work your organization does could end up being your chance to get a foot in the door. Networking is absolutely essential in nonprofit work, but be sure not to become so focused on getting to the top right away. Conversation with professionals at every level can become an incredible opportunity, and you’ll be amazed at how many connections you’ll be able to make if you are open to it. Some companies even have rules against donating to any organization without the request being attached to a relationship with someone at any level within the company. Pinpoint Win-Win Opportunities Before you approach a company about donating to your organization, it is important to do the work of learning everything you can about it. Take a close look at the products or services the company offers, how they market their products, what their sales are like, whether the company is on the rise, what its community relationships look like, and so on. The more you know about the company you plan to approach, the better equipped you will be to establish a positive rapport. Once you have gathered as much information about the corporation you are interested in as possible, you will be able to pinpoint win-win opportunities that may exist for your two organizations. Imagine, for instance, that your nonprofit serves a particular community that is vested in the success of the corporation you are looking to work with, or vice versa. In this case, it would be mutually beneficial for the company to make a donation, since their donation would be going towards initiatives that indirectly benefit them. Knowing as much as possible before you reach out to request a donation can also help you to tailor a personalized sponsorship package request, which will make your case far more compelling than one of the generic requests they frequently receive. Be Open to Non-Financial Donations While we often think of ‘donations’ as being monetary, corporate donors have much more to give than just money. While financial donations can be a massive help to any nonprofit, there are plenty of corporations that specialize in services that are much needed or could be used in a way that could benefit a nonprofit-- think law, food service, accounting, insurance, entertainment. Some companies may want to offer their specific services pro bono, outfit your nonprofit with the product(s) they make, or even volunteer their own time to your cause. Remember those win-win opportunities you want to look for in order to land more corporate donations? This is a great example of exactly that kind of situation. Some companies may not even consider donating money to your nonprofit unless they are allowed to document that their employees volunteer with your organization. These kinds of non-financial donations can be extremely valuable, and should not be ignored or considered a lesser donation than a monetary one. At Blackbird Philanthropy Advisors, we work closely with businesses to help them manage and organize their philanthropic efforts. If you want to learn more, we’re sharing tons of tips, tricks, and information for nonprofit and community organizers over on our blog. Independent Sector is the only national membership organization that brings together the charitable community—a diverse set of nonprofits, foundations, and corporations—to advance the common good. The charitable sector provides millions of people with powerful, independent, and voluntary methods for addressing the issues and expressing the values most important to them.

Individuals

Small Nonprofits (Fewer than 500 Employees)

Large Nonprofits (More than 500 Employees)

Additional Resources  You’re excited. You’re a 501c3, you’ve got a great mission and now you’re ready to get some of those grant dollars you’ve heard so much about! Where do you begin? The good news is – it’s true, there are a lot of opportunities to find funders who want to invest in your cause. The bad news is, you may be a ways off from getting their attention. It’s especially difficult for brand new organizations to receive grant funding without 2-3 years of success under their belts to show they’re worth the investment. Hang tight and arm yourself with our list to get you and your team on the path to grant funding success. This article will give you an insider’s track guide to everything you’ll need to gather and have on-hand to begin applying for grants. 1. BALANCE YOUR BUDGET Many major funders admit, the first thing they do when they read a grant application is go straight to the budget. 9 times out of 10, a grant application will require a copy of your organization’s annual budget. On the budget, funders are looking to see that you’re fiscally solvent, fiscally responsible, and competent. How does a budget show them these things?

2. COVER YOUR BASES 99.9999% of grant funders will require that you are 501c3 tax exempt organization. Here’s a list of the all the items the vast majority of grants require.

Many grant funders will also ask for a deeper dive of information that includes:

3. KNOCK 'EM DEAD Alright, you’ve covered all your bases and now you’re ready to actually fill out the application. What kind of information will you need to fill out the application? The vast majority of grant application and letters of inquiry will ask for these four elements for the program or project you’re requesting funding for:

Many times, you’ll also be asked to include one or more (or all!) of the following:

4. GET IT RIGHT Finally, there are a number of random little red flags that may pop up around your application. Because grants are hugely competitive to win, a red flag might throw your whole application off. If you can get yourself grant-ready starting NOW, you won’t have to worry about that when you’re all set to apply.

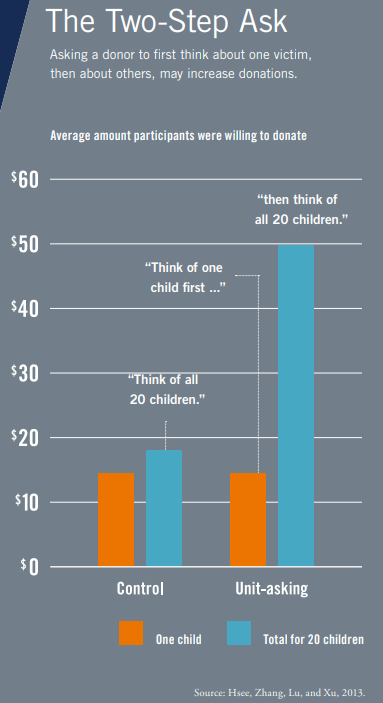

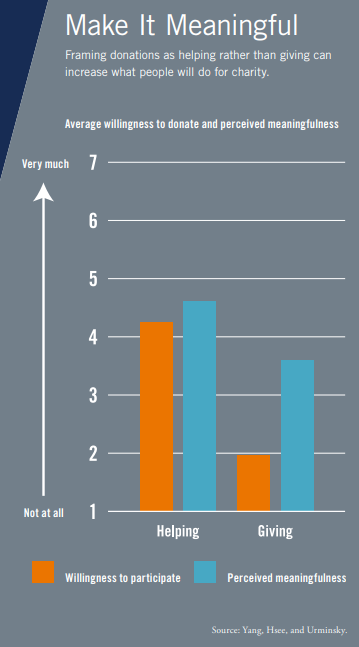

University of Chicago Booth School of Business’s Rustandy Center for Social Sector Innovation, this guide provides four research-based ideas you can implement today. The Rustandy Center for Social Sector Innovation is the Chicago Booth business school's social impact hub and destination for people tackling complex social and environmental problems. This information is provided by the Rustandy Center in their downloadable e-book here.

3. Make Your Fundraiser Exceptional

Reframing your annual fundraiser as a unique opportunity can drum up higher donations. Abigail Sussman, associate professor of marketing at Chicago Booth, finds that minor differences in the way a charity frames its donation plea, as either a regular occurrence or an exceptional one, can make a big difference in how likely people are to donate. For example, researchers altered the wording in online ads for the Alzheimer’s Association’s annual charity walk, so that one ad read “Held annually for Alzheimer’s,” while another read “Only once a year for Alzheimer’s.” People were more likely to click through and donate for the latter, when the walk appeared to be an exceptional rather than a regular occurrence. 4. Give Suggestions... Carefully Not all donors are created equal. Whether first-time donor or seasoned philanthropist, offering suggested donations can help guide their giving with positive results. “Small changes can impact people’s choices, especially for people who aren’t sure what their actual preferences are,” says Urminsky, who is conducting research with Indranil Goswami, assistant professor of marketing at the School of Management at the University at Buffalo. Urminsky and Goswami find that setting higher default donation amounts increases how much a donor gives, but can reduce the number of donors. When targeting likely donors, suggesting larger amounts can be beneficial. If boosting participation is the primary goal, setting a low default can increase donation rates. When setting default donations, understanding your donors and their commitment to giving is key.  What happens when your nonprofit is engulfed in scandal? Or what if you have a board member or highly visible donor who’s reputation is significantly on the rocks? As always, being prepared for crisis and scandal is always the best policy. Every nonprofit leader should know when and how to act in times of trouble. Managing these crises is especially important when it comes to fundraising and mission advancement. Fundraising is all about managing relationships. In times of controversy or not, nonprofit executives should be carefully navigating through their relationships with stakeholders. When there is a crisis, the trust they’ve built along the way will have the biggest impact on successfully wading through the times of murky waters. In general, it is good to have open, honest communication with all of your stakeholders so a crisis doesn’t tip you over the edge but makes everyone come out stronger. If news breaks that a major donor was engulfed in scandal, a nonprofit executive should remain calm and act swiftly with integrity. A solution and plan of action to mitigate the crisis should be immediately ready to go. This includes knowing who to pull into a room for immediate strategy, who to contact first, and who are the best people to carry out the plan. Communicating clearly, concisely is paramount. Your main strategy will need to be disassociating your mission with the person experiencing the scandal. Your core group of loyal stakeholders should continue to feel that you are an organization they can trust. Continue to align their passions and initial interest in the work of your organization with the impact and mission you make in the world. The scandal could, in effect, give you an opportunity to engage your stakeholders in a closer, meaningful way that ignites even more respect and loyalty than before. Blackbird Philanthropy Advisors featured in Yahoo! Finance article on "How to Start a Nonprofit"12/4/2018  If you're passionate about a certain issue or cause, you may decide to go beyond donating your time and money to a charitable organization and start a new nonprofit. But before forming a nonprofit for personal fulfillment, there are a few crucial financial and logistical steps to address, including financing and taking advantage of tax exemptions to ensure the organization can solely focus on its core mission, not unnecessary expenses. You'll also want to consider whether you have the time to start a nonprofit, and if you'll need to be paid for the time you put into creating and operating the organization. Choosing whether or not to receive a salary is one of the fundamental differences between launching a nonprofit versus a for-profit business. With a for-profit business, you can earn as much as your business can afford to pay you; with a nonprofit, if you generate more than what the IRS considers "excessive," you could pay an excise tax and lose your tax-exempt status. So, if you're contemplating forming a nonprofit, there are a number of factors you'll need to consider to meet your organization's goals. With that in mind, here's what you need to know to get started. Research the prospective charitable cause. Conduct a competitive analysis to determine if there are other organizations addressing the same issue. If there are competing nonprofit organizations, it doesn't mean you shouldn't start a new nonprofit, but you do want to know the lay of the land, says Caitlin Worm, managing director of Blackbird Philanthropy Advisors, a nonprofit based out of South Bend, Indiana, that works to help businesses be strategic about their philanthropic giving. "If you can't find anyone doing the same exact thing, it could be a good sign, but maybe you can find an organization that does similar work and help them build a program to help your intended population rather than building a new organization from scratch," Worm says. "It's always a good idea to make sure you are not replicating services already being offered at satisfactory levels. ... For example, if you want to start a food bank, you may want to do a search for food banks in your community and find out what works and what doesn't work before you start a new one on your own." Consider incorporating your nonprofit. The process varies by state, but you'll likely need to register your nonprofit with your secretary of state's office, which typically requires a filing fee (in Ohio, for instance, it requires a $99 fee). You'll also want to choose a corporate name for your nonprofit. Weigh the pros and cons of tax-exempt status. If you've done your research, and you're certain that there is a need for your nonprofit, you'll want to make sure the IRS agrees. James Hsui, a New York-based attorney who specializes in offering legal advice to nonprofits, says that most nonprofits that are exempt from taxes are under Section 501(c)(3) of the U.S. tax code. "However, Section 501(c)(1) to 501(c)(29) all describe tax-exempt entities that could be classified as a nonprofit, and it is also not a requirement for nonprofits to be tax-exempt," Hsui says. How do you decide whether or not to file for tax-exempt status? Whether you seek out this tax exemption is something you should discuss with an attorney like Hsui, but assuming you're going to form a 501(c)(3) nonprofit, you'll be involved in a two-step process. First, you'll need to form the nonprofit as a corporation, trust or unincorporated associated with your state. "For most nonprofits, the corporation is often the best option because it provides the broadest amounts of liability protection for its directors, officers and other insiders," Hsui says. "Once the underlying entity is established, the next step is to apply for the entity to be recognized as a tax-exempt 501(c)(3). This involves filing either Form 1023 or 1023-EZ with the IRS." The latter form is faster, but if you expect to receive more than $50,000 in annual gross income for the next three years -- or you're starting a church or school -- you need to fill out Form 1023, Hsui says. "If everything goes well with the application for recognition, the entity will receive a favorable decision letter usually somewhere between two weeks and nine months," Hsui says. He adds that the time it will take to hear back from the IRS will depend on factors such as what type of form was used, the current backlog of applications, the complexity of the nonprofit's activities and whether any issues of concern were found by the officer examining the application. "I highly recommend hiring a lawyer, tax advisor or business consultant to help you walk through the steps of the form correctly the first time or you could risk having your application rejected or sent back for revisions," Worm says. "There are horror stories of these revisions and resubmit processes taking months, if not years, to complete because of minor errors on the application." Assemble a board of directors. If you're serious about starting a nonprofit, you'll need a board of directors. In fact, when you register your charity, you'll need to provide the IRS with names of three individuals who are your board of directors. Also, keep in mind the IRS prefers that the organization's board of directors are unpaid. You are allowed to have more than three board of director members, but experts suggest making sure your number is uneven, so when you have big decisions, such as how to spend money, you won't have a tie. Remember: Nonprofits require financing. Starting a nonprofit is tough enough, but running it indefinitely isn't easier. You'll need to have an interest in raising money or your board will need to be passionate about it. It's also beneficial to have a business plan. You'll want to create a road map that shows a fundraising and operational plan, and include an executive summary to entice organizations and foundations to offer grants for your nonprofit. "Startup nonprofits need to have board members who will aggressively and unashamedly lead, bringing in donations and other influencers that can help the nonprofit grow and get the traction that will lead to a healthy, sustainable inflow of donations," says Peter Dudley, chief development officer of Cancer Support Community San Francisco Bay Area. That's because fundraising will be a big part of your nonprofit's existence. "I've seen a lot of nonprofits struggle with cash flow because they underestimate the amount of time it takes to bring in donations. People passionate for their work often think that passion will translate into donations, and they also think that if a person will donate to this, then they will donate now," Dudley says. But it doesn't always quite work out that way. "In reality, a lot of people who are willing to donate will need to be asked several times, over a period of time, before writing that first check," Dudley says. "People often will also want to see some traction or a critical mass before writing bigger checks. They'll donate $25 or $50 but will wait until you're established before giving at a personally meaningful level." Many people wonder if they could afford to hire a nonprofit performance consultant. Our answer is simple in many cases: you can't. Do you want to be the best leader possible? Do you want to spend all of your energy working toward you mission? Would you like to improve in areas where you feel you face more challenges? These are all good reasons to hire a consultant.